After years of training my coaching job shoppers on the way to properly style their own investment plans, I’ve detected there are 3 distinct varieties of investors.

1. Pre-Investor

2. Passive investor

3. Active investor

Identifying your capitalist sort can assist you understand the results of your investment vogue. You’ll learn the restrictions and blessings that naturally result from the approach you invest.

There’s no right answer to the question, “What is that the best investment type?” but, there’s a right answer unambiguously suited to your state of affairs.

Only one investment kind is suitable for your commit to bring home the bacon wealth, and your job is to work out what that kind is. every investment type builds on the talents of the sort below it. thus despite what style of capitalist you’re currently, consequent level is simply a touch follow and education away.

Investor Type 1: Pre-Investor

Unless you were born with an inherited wealth in your mouth and a monetary fund to match, then you doubtless began life as most people do: a pre-investor.

A pre-investor is just somebody WHO isn’t finance.

Pre-investors are characterised by stripped-down monetary consciousness or awareness. There’s very little thought of finance, and there are correspondingly very little savings or investment to indicate for that stripped-down thought.

Some pre-investors have a corporation pension account, however that wouldn’t exist had the personnel not set it up for them.

The pre-investor’s monetary world is primarily regarding consumption, that takes precedence over savings and investment.

As wage-earners, they usually live bank check to pay-check basic cognitive process their monetary difficulties are going to be resolved by consecutive pay increase. once pre-investors earn additional, they pay additional, as a result of life style is additional necessary than monetary security.

Investor Type 2: Passive Investment Strategy

Most money establishments, academic services, and internet sites support passive finance as a tested, accepted answer. Most of what you’ll learn from the data obtainable in your native bookstall or on the net is that the typical knowledge of passive investment ways.

Passive finance is wherever the retail world of investing lives. whereas there are not any onerous statistics to support my claim, i think run out ninetieth of all capitalists be the passive investor class.

The passive capitalist kind sometimes employs all the fundamentals of sound personal money planning: own your own residence, fund tax-deferred retirement plans, quality allocation, and save a minimum of 100 percent of earnings.

Investor Type 3: Active Investor

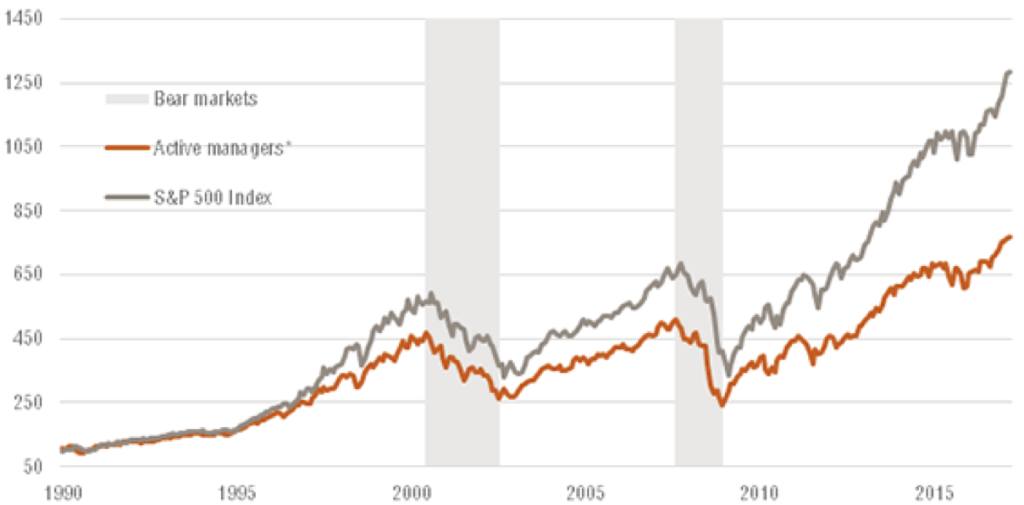

The primary distinction between active and passive capitalists is that the active investor not solely receives market-based passive returns, however he conjointly gains a added come stream supported skill; 2 sources of return in one investment.

This allows the active capitalist to form cash no matter market conditions or direction and to scale back losses during times of adversity. this is still the potential to extend returns and lower risk.

A primary distinction between passive and active investment methods is passive investors push to amass and save cash, however pay so much less energy creating their cash work for them.